corporate tax increase build back better

The corporate tax increase proposal in. A 15 minimum tax on the financial statement book profits of corporations that report over 1.

Pin By Steph Johnson On Politics Letter To The Editor Brookings Low Taxes

Surcharge on high income individuals estate and truststhe bill would impose a tax equal to 5 of a taxpayers modified adjusted gross income MAGI in excess of 10 million and an.

. Corporate income tax rate increase. The international tax reforms included in the Act would decrease tax haven abuse and the offshoring of jobs while raising revenue for. Amazon Bank of America Facebook FedEx General Motors Google Netflix PayPal T-Mobile and Verizon are just a few of the 70 corporations that would have paid more taxes under the Democrats proposed Corporate Profits Minimum Tax.

Create a 1 excise tax on net stock buybacks. The Build Back Better Act has tax components related to children health care education state and local taxes corporate profits and retirement plans among others. Despite what its promoters say.

The Financial Accountability and Corporate Transparency FACT Coalition urges Congress to advance needed international tax reforms as part of the 2021 budget reconciliation process by passing the Build Back Better Act HR. More importantly though is what is out and in the legislation including. In a new analysis the Tax Policy Center estimates that the major tax changes in the latest version of President Bidens Build Back Better plan.

The revised bill makes significant changes to and departures from the tax proposals approved in the September 13 2021 version the September version 1 not to mention brushing aside the Senate Finance Committees Billionaires Tax. The bill contains a wide variety of tax provisions. President Joe Bidens Build Back Better agenda would raise taxes on up to 30 percent of middle-class families despite his campaign promises saying otherwise.

Adding in 207 billion of nonscored revenue that is estimated to result from increased tax enforcement in the bill the net total increase to the deficit would be 160 billion. The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR. Individual ordinary income tax rate.

The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years. First under current law the top marginal tax rate on ordinary income is scheduled to increase from 37 percent to 396 percent starting in 2026 according to the Tax Foundation. Bidens tax proposal in infrastructure plan would hurt the US against competitors like China.

Requiring people with high incomes to pay a fairer amount of tax reducing unwarranted tax advantages for profitable corporations particularly large multinationals and improving enforcement of the nations tax laws to close the roughly 600 billion annual gap between taxes legally owed and taxes paid. It started at 2466 pages was cut by the Rules Committee to 1684 pages and the final iteration was back up close to 2200 pages. They specifically referenced Amazon which they said reported 45 billion in profits over the past three years yet paid an effective tax rate of just 43 well below the 21 corporate tax rate.

2 15 percent of earned income above 2500. 5376 the Build Back Better Act. The BBB has gone through quite a metamorphosis.

BEAT ratethe bill would increase the base erosion and anti-abuse tax BEAT rate to 125 for 2023 15 for 2024 and 18 for 2025 and thereafter. Looking only at direct taxesindividual income taxes and payroll taxesthe plan also would cut 2022 taxes on. 5376 that includes more than 15 trillion in business international and individual tax increase provisions.

Report Illustrates How 70 Corporations Could Be Affected by Minimum Tax Proposal in the Build Back Better Act. 1 1400 or. Impact of Tax Increases that Could Fully Pay for Build Back Better Long-run GDP Long-run Full-time Equivalent Jobs millions Long-run After-tax Income of Middle Class 10-Year Static Tax Revenue trillions Add a Flat Individual Income Tax of 5-21-22-44.

But the corporate share of federal tax revenue has dropped by two-thirds in 60 years from 321 of federal revenue in 1952 to 99 in 2012 according to the Office of Management and Budget. Not only will President Bidens Build Back Better Agenda protect more than 97 percent of small business owners from income tax increases it will also provide well-deserved tax cuts to Main. Build Back Better 20 Still Raises Taxes For High Income Households And Reduces Them For Others.

Assuming the taxpayer had enough earned income even if there was no tax liability they would receive a check from the IRS of 4200 1. According to a fact sheet from the White House a new Treasury Department analysis shows that the proposal wouldnt increase income tax rates on 97 of small business owners and would provide. Raise Individual Income Tax Rates by 10-09-10-11.

Senate Democrats are proposing new tax increase measures to offset the cost of Build Back Better reconciliation legislation in response to objections from Senator Krysten Sinema D-AZ to increasing the marginal tax rates for corporate individual and capital gains income. The House-passed Build Back Better legislation is expected to be revised by the Senate which would then require further action by the House. The legislation would raise revenue in three main ways.

Miscellaneous corporate tax increases-01-01-02-01-17000. Impose a 15 percent minimum tax on corporate book income for corporations with profits over 1 billion-01-01-03-01-27000. On October 28 2021 the House Rules Committee released a revised version of HR.

The latest framework for the legislation proposes changes to the tax code that would the White House says raise more than 199 trillion to cover their 175 trillion Build Back Better agenda.

Us Treasury Pushes Back As Budget Office Warns Biden S Bill Will Swell Deficit As It Happened Us Politics The Guardian

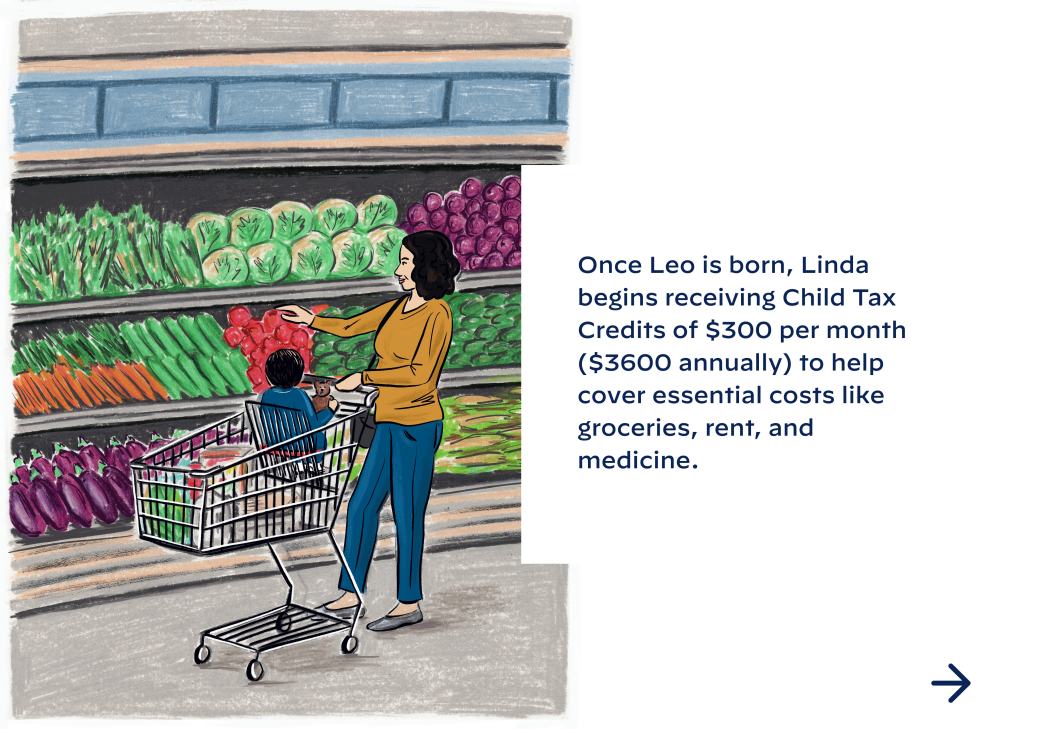

The Build Back Better Framework The White House

7 Factors Driving Electric Vehicles Ev S Adoption Electric Cars Electricity Adoption

The Build Back Better Framework The White House

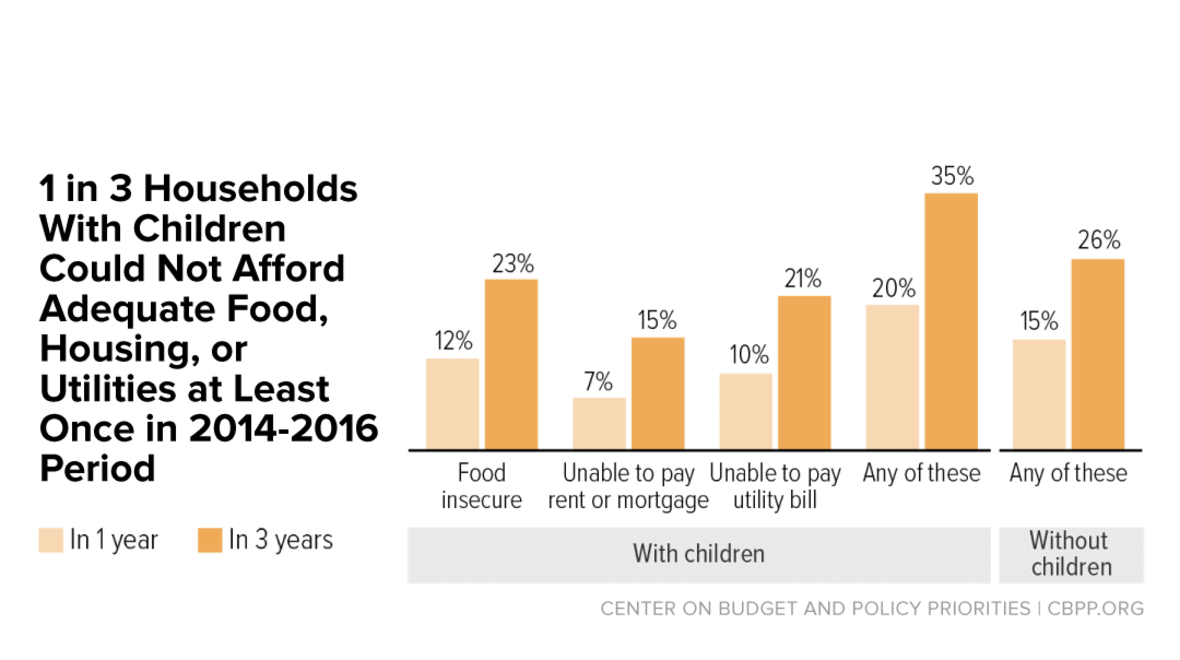

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

Infographic 5 Reasons For Upgrading To Magento 1 8 Magentoce Community Edition Magento Infographic Upgrade

Manchin Says Build Back Better Is Dead Here S What He Might Resurrect

Ey Are You Prepared For Corporate Reporting S Perfect Storm Complexity And Demand Continue To Rise Perfect Storm Finance Infographic Finance Function

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

The Build Back Better Framework The White House

The Build Back Better Framework The White House

Pin By The Intelligent Investor On Money In 2022 Money Strategy Trading Charts Money Saving Plan

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities